Note: This is me talking, not the team. I’m very passionate about having an actual use case for the token, as I think it’s the best way for us to withstand bear markets and succeed in the long run.

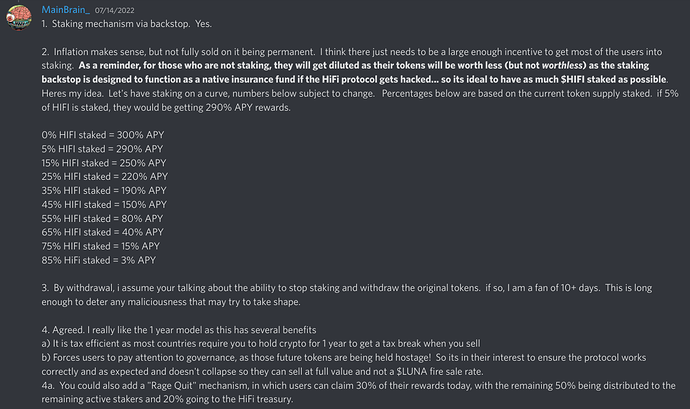

The consensus in the community regarding token-utility right now is that the new HIFI token will be used for governance voting, as well as staking. Staking would be a way to act as a backstop in case the protocol gets hacked, where stakers would lose a share (or the entirety) of their staked HIFI tokens. They would, of course, be incentivized to stake their funds thanks to a healthy APY.

While it’s not official yet whether or not there will be a staking mechanism in the token-economics proposal of the Hifi team (while I’m part of the team, I’m not aware of the exact plans yet for the token-economics), it’s clear to me that a staking mechanism isn’t enough.

We need actual token utility.

Governance isn’t actual token utility. Yes, you get to use your tokens to vote, but it doesn’t make the token part of the protocol itself. Proof is there are a lot of projects out there where the token is only used for governance, and they could perform equally well with or without it.

Staking isn’t actual token utility. In the current way we (the community) think of staking (where it acts as a backstop), all you do is deposit your HIFI tokens in the protocol, and that’s it. It can still be a passive investment. Someone could invest, come back in 5 years (while not having voted on any governance proposals) and have benefitted massively from this staking mechanism without having done anything for the project (except acting as a kind of insurance mechanism in case the protocol gets hacked).

Some examples of actual token utility include Ethereum where ETH is used to pay for transaction fees as well as to secure the network thanks to proof of stake, Synthetix where SNX is used to act as collateral to enable the creation of synthetic assets, The Graph where GRT is used to signal noteworthy subgraphs as well as a reward those who index subgraphs…

These protocols are built around their token, whereas usually the opposite happens with the token being grafted to the protocol. We want to be in the camp of those with a protocol built around the HIFI token, because that’s how we will withstand bear markets.

This is a call to the community to start QUICKLY and SERIOUSLY thinking about the best ways we could get actual token utility. We can get governance voting for the token, we can get a staking mechanism acting as a backstop, but we need more.

There have been countless discussions about the token-swap ratio, which doesn’t matter ultimately, whereas this does. If something is going to make you rich, it will be the actual economic system backing the HIFI token, not the swap ratio. It’s in our best interest to figure this out.